Welcome to the EPIC! Loans Blog

This blog is your best guide that is all about loans!

Welcome to the EPIC! Loans Blog

This blog is your best guide that is all about loans!

SUBSCRIBE TO OUR NEWSLETTER

Be the first one to read our blog articles by subscribing to our newsletter.

Mortgage Rates Are Stabilizing – How That Helps Today’s Buyers

Mortgage Rates Are Stabilizing – How That Helps Today’s Buyers

Over the past few years, affordability has been the biggest challenge for homebuyers. Between rapidly rising home prices and higher mortgage rates, many have felt stuck between a rock and a hard place.

But, something pretty encouraging is happening. While affordability is still tight, mortgage rates have shown signs of stabilizing in recent months. And that may finally make it a bit easier to plan your move.

Mortgage Rates Have Stabilized – For Now

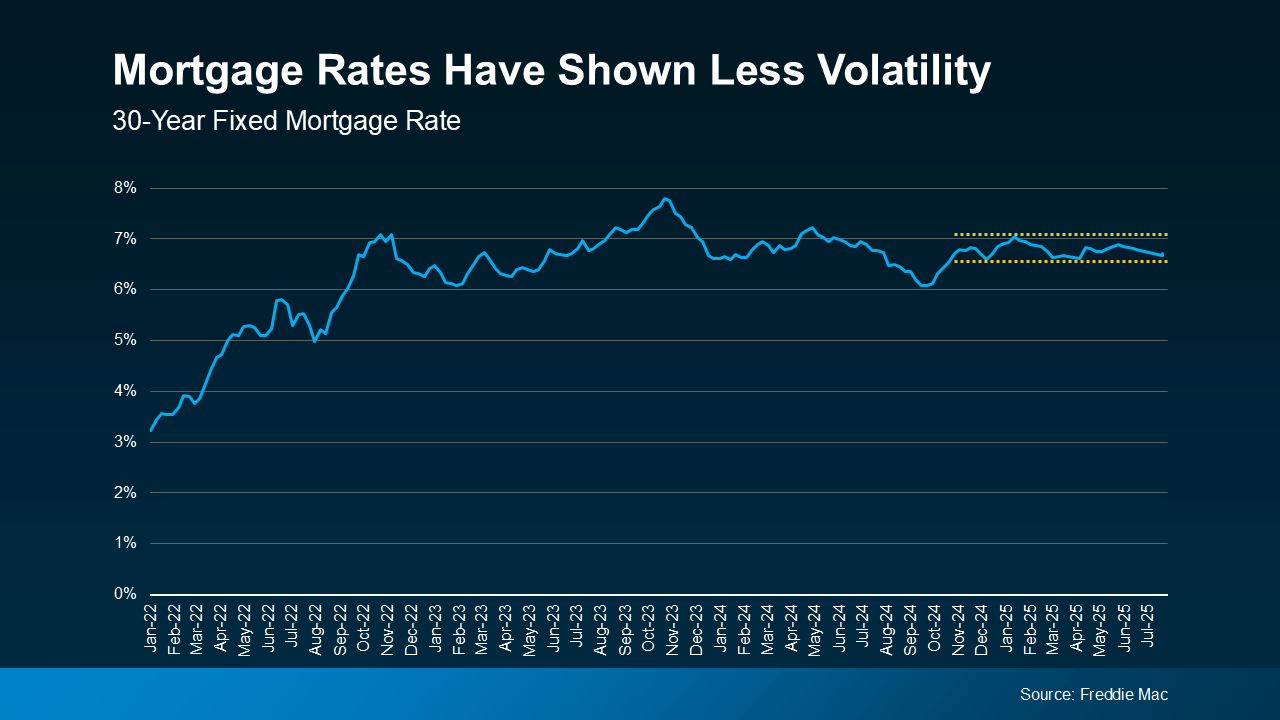

Over the past year, mortgage rates have had their share of ups and downs, making it tough for buyers to know what to expect. But recently, rates have started to level out and have settled into a more narrow range (see graph below):

As the graph shows, rates have stayed within that half-percentage-point since late last year. Yes, there’s been movement within that range, but wild swings and sudden ups and downs just haven’t been the story lately. And that’s a bigger deal than you may realize. As HousingWire explains:

“Analysts, economists and mortgage professionals are coining this quarter’s activity as one of the most “calm” periods for mortgage rates in recent memory.”

How This Helps Today’s Buyers

Let’s be real. Unpredictability makes it tough to plan ahead. When rates are bouncing around and making big jumps week to week, it’s easy to be intimidated. But with rates staying in a pretty steady range over the past several months, you have a clearer picture of what your potential monthly payment could look like. That makes moving feel less uncertain – and more doable.

So, stop waiting. And start planning. Even though rates may not be where you want them to be right now, they have been much less volatile for quite some time.

Will This Stability Last?

According to the experts, it looks like that stability might hang around for a bit. Rates may come down ever so slightly in the months ahead, but it’ll likely be a slow and mild change. As Danielle Hale, Chief Economist at Realtor.com, says:

“I expect a generally downward trend for rates this year, but at a slow enough pace that it might not be noticeable in any given month.”

So, if you’ve been holding out for the perfect mortgage rate, the best advice is to avoid trying to time the market. It may not look terribly different than the opportunity you already have in front of you. As Jeff Ostrowski, Housing Market Analyst at Bankrate, explains:

“Trying to time mortgage rates is really difficult. There’s no guarantee that rates are going to be any more favorable in three months or six months.”

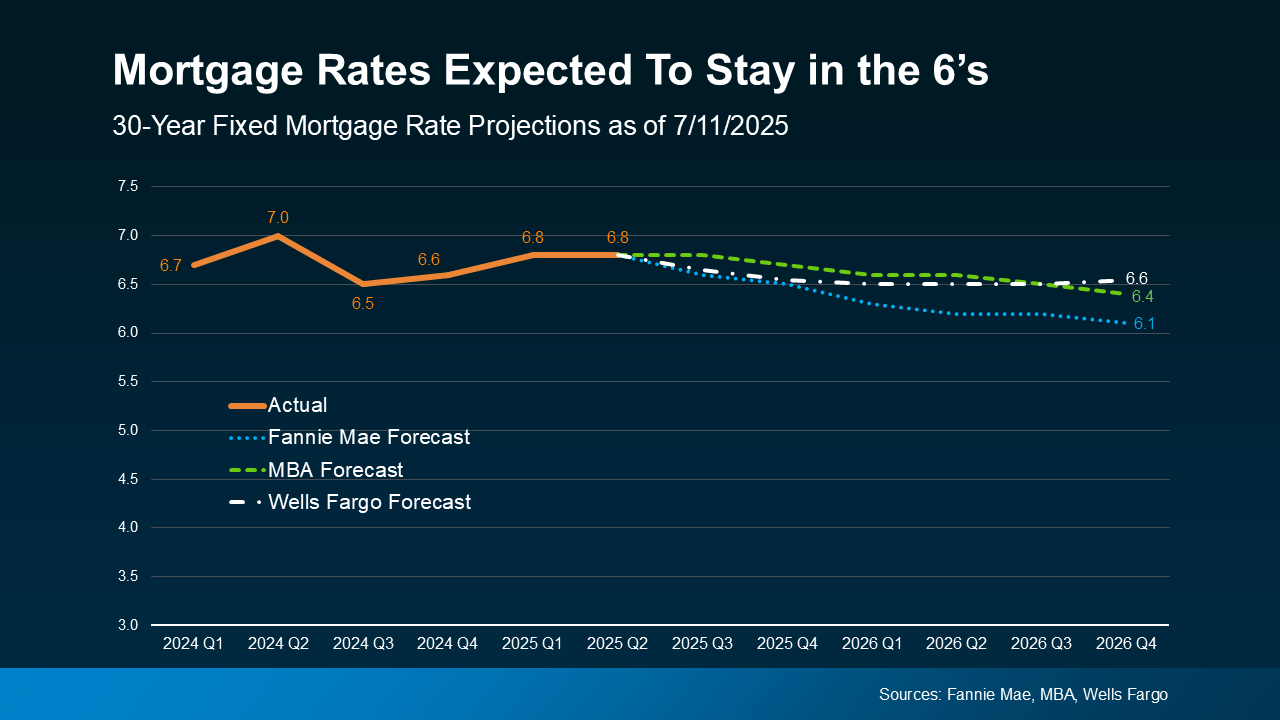

And if we look at the latest expert forecasts that go out a bit further, even those tell much of the same story. Two out of the three projections say rates will still likely be in the mid-6% range by the end of 2026 (see graph below):

This puts today’s buyers in a much better spot. As Sam Khater, Chief Economist at Freddie Mac, explains:

“Mortgage rates have moved within a narrow range for the past few months . . . Rate stability, improving inventory and slower house price growth are an encouraging combination . . .”

Just remember, mortgage rates are still going to react to changing economic conditions, inflation, and more – and that means they could shift again. But right now, you’ve got more predictability, and that means more opportunity, too.

While affordability is still a challenge, the market may be offering a bit more stability – and that makes planning your next move a lot easier.

Let’s connect if you want to run the numbers and see what a monthly payment would look like in today’s market. That way you can stop waiting and start planning.

Read More About:

Mortgage Rates Are Stabilizing – How That Helps Today’s Buyers

The Winds Are Shifting: A New Era in Homebuying

For the last several years, the path to Buying A Home has felt like crossing a rickety bridge in a storm—high home prices, relentless interest rates, and a market teetering on unpredictability. But something’s changed. The gales have calmed, and the landscape, while not perfect, is more navigable.

Welcome to the calm period for mortgage rates.

It’s not just a breather—it’s a beacon. After months of economic unrest and price frenzy, Mortgage Rates Are Stabilizing, offering homebuyers a much-needed moment of clarity. And when you look beneath the surface, this pause could very well be the market opportunity smart buyers have been waiting for.

Why Mortgage Rate Stability Changes Everything

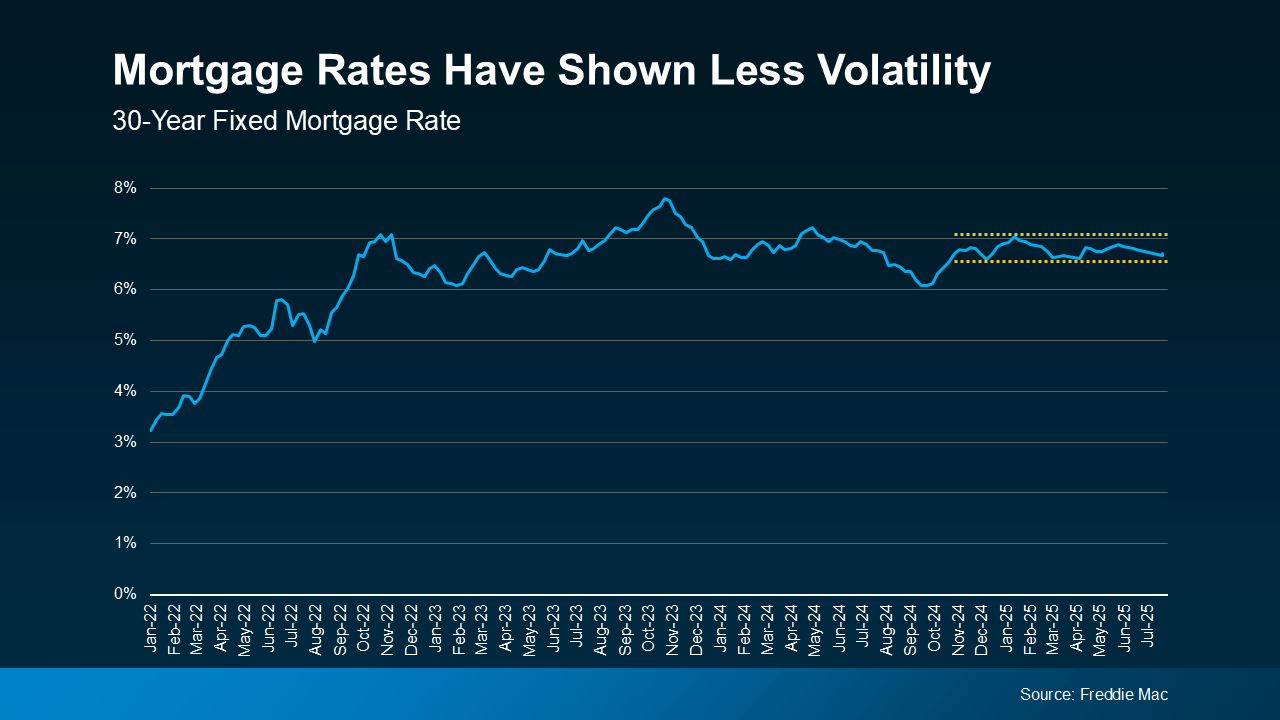

A year ago, watching rate fluctuations was like tracking a wildfire—unpredictable, fast-moving, and downright stressful. But now, we’re seeing Mortgage Rates settle into a narrow range, hovering with more consistency.

This newfound rate stability does something remarkable: it creates predictability in rates. And with that predictability comes power. Buyers can finally sit down, crunch numbers, and plan with a real sense of control.

Whether it’s calculating a monthly payment or analyzing mortgage forecasts, the game has changed. Less volatility. More strategy.

As noted by HousingWire, this isn’t just a short break from chaos—it’s one of the most composed chapters in mortgage rate history:

“Analysts, economists, and Mortgage Professionals are coining this quarter’s activity as one of the most calm periods for mortgage rates in recent memory.”

Let that sink in. This isn’t just relief—it’s renaissance.

How Buyers Benefit From Rate Stability

When interest rates were leaping like acrobats from week to week, real estate planning became an exercise in futility. Buyers were paralyzed by the fear of locking in a loan one day, only to see better numbers the next. That uncertainty killed momentum.

Now, with Stabilizing mortgage rates, the fog is lifting.

The steadiness of todays market gives buyers something critical: confidence. They’re no longer scrambling to “catch the dip” or worried about making a move in a hyper-volatile environment. The numbers may not be at historic lows, but they’re predictable—and that alone can swing the scales from hesitation to action.

Here’s what’s happening now:

Homebuyers are better able to estimate what their monthly payment will look like.

Lenders are providing more reliable quotes and timeframes.

Realtors and financial advisors can strategize effectively with clients.

And in places like Florida? The search for Affordable West Palm Beach home loans is getting a boost from lenders encouraged by rate steadiness.

Rebuilding Affordability in a Shifting Market

Yes, affordability is still a hurdle. But let’s look at the math.

Pairing Mortgage Rates that are no longer skyrocketing with signs of slower house price growth means that buyers are getting closer to a sustainable balance between income and housing costs.

Housing affordability is inching back into the conversation—and not just nationally. In hotspots like South Florida, the door is cracking open wider. With the help of a West Palm Beach mortgage broker, buyers are finding real options to make ownership attainable.

Tools like West Palm Beach mortgage calculators are turning dreams into digits. Buyers can now project costs with a level of accuracy not possible six months ago. That’s power. That’s progress.

Economic Conditions and the Bigger Picture

Let’s not ignore the elephant in the room: the macro landscape. Economic conditions remain in flux. Inflation has cooled slightly but still hovers above comfort levels. Wage growth is real but uneven. The Fed still watches from the wings.

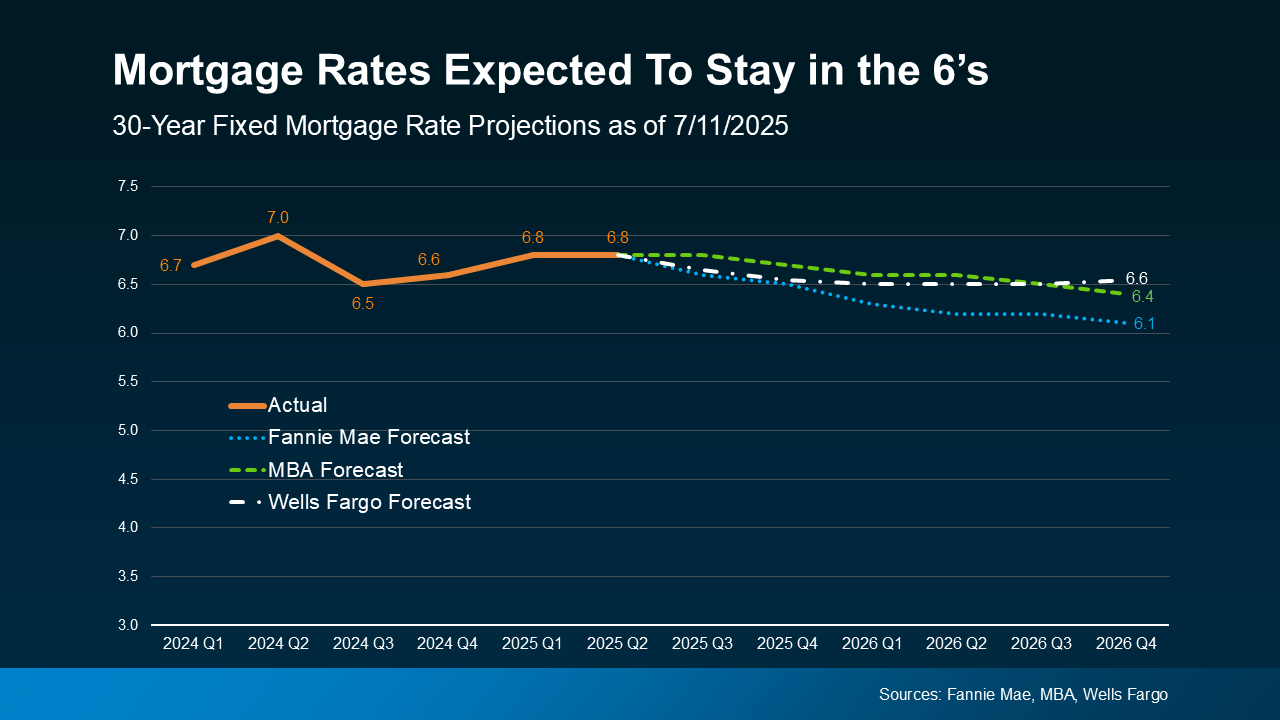

Still, with all these variables, the latest expert forecasts point to continued stability—or even a slow rate change downward.

According to Realtor.com’s Chief Economist, Danielle Hale:

“I expect a generally downward trend for rates this year, but at a slow enough pace that it might not be noticeable in any given month.”

That’s not fireworks. That’s a gentle, almost imperceptible current—exactly the kind of subtle momentum that seasoned buyers capitalize on.

Stop Trying To Time the Market

The idea of waiting for the perfect mortgage rate? It’s time to shelve that strategy.

Jeff Ostrowski, Housing Market Analyst at Bankrate, cuts to the chase:

“Trying to time the market is really difficult. There’s no guarantee that rates are going to be any more favorable in three months or six months.”

He’s right. The smart money doesn’t wait for magic. It moves with intention in the window that exists now. And that window—while not a grand opening—is a clear one.

Inventory Is No Longer the Villain

Here’s another plot twist: Inventory is rising.

Yes, the ghost town that was the housing shelf in 2022 is slowly restocking. Improving inventory levels are giving buyers more options—and more leverage. This combination of better supply and stabilized rates means negotiations are getting less cutthroat.

This shift is especially pronounced in cities with aggressive growth and strong loan infrastructure. In South Florida, buyers have a wider selection and access to more favorable lending tools like:

First time home buyer loans in West Palm Beach

West Palm Beach refinancing options

Local mortgage lenders in West Palm Beach

Mortgage preapproval in West Palm Beach

Even niche offerings through a Commercial mortgage broker in West Palm Beach

The doors aren’t just open—they’re being held wide.

A Spotlight on West Palm Beach

Let’s zero in on one market that’s benefiting greatly from this stability: West Palm Beach.

A region once infamous for bidding wars and razor-thin margins is now seeing a renaissance in buyer confidence. With Best mortgage rates in West Palm Beach holding steady, aspiring homeowners are finally finding their footing.

For those considering making their move, having a trusted West Palm Beach mortgage broker by your side is invaluable. From navigating West Palm Beach mortgage calculators to securing Property loan advice in West Palm Beach, the resources available today outpace what was accessible during the chaos of previous years.

And let’s not forget the magic of preapproval. A fast-track mortgage preapproval in West Palm Beach could be your golden ticket in a climate where timing and preparation matter more than ever.

Where We Go From Here

It’s tempting to get comfortable with the word “stable.” But Mortgage Professionals know better: markets shift, tides turn, and tranquility isn’t forever.

Mortgage Rates are still sensitive to broader economic conditions—especially if inflation takes another unexpected turn. But for now, the outlook remains cautiously optimistic.

Freddie Mac’s Chief Economist, Sam Khater, underscores this sentiment:

“Mortgage rates have moved within a narrow range for the past few months… Rate stability, improving inventory, and slower house price growth are an encouraging combination.”

Translation? Opportunity is no longer hypothetical—it’s here.

What To Watch For

If you’re still on the fence, keep your eyes on these key indicators:

Inflation trends and how they influence Fed policy

Changes in wage growth vs. home prices

Ongoing updates from expert projections and financial institutions

Local trends—especially in West Palm Beach, where lenders are uniquely positioned to offer regionalized insights

As Mortgage forecasts evolve, staying informed and working with localized experts—especially Local mortgage lenders in West Palm Beach—can give you an edge.

Making Your Move in Today’s Market

Whether you’re a first-time buyer, an investor, or just someone looking to put down roots, todays market offers clarity we haven’t seen in years.

And clarity is currency.

Let go of outdated expectations about 2% rates or once-in-a-lifetime deals. Instead, embrace the current climate for what it is: a season of strategy. Use tools. Ask questions. Leverage insights. Lean on pros like a Commercial mortgage broker in West Palm Beach if your plans include multi-unit or investment properties.

This isn’t about waiting for perfection. It’s about acting during the calm period for mortgage rates, when the waters are smooth enough to chart a real course forward.

Final Thought

Affordability is still a battle—but we’re no longer fighting blind.

With Stabilizing mortgage rates, more inventory, and actionable insights from the latest expert forecasts, this is no longer the treacherous terrain of last year. It’s a path with guardrails. A road with direction.

And in places like West Palm Beach, the combination of Affordable West Palm Beach home loans, smarter tools, and seasoned Mortgage Professionals means you’re not going it alone.

The time to move isn’t someday. It’s now.

And this time? The bridge looks a lot sturdier.

Read from source: “Click Me”

Mortgage Rates Are Stabilizing – How That Helps Today’s Buyers

Mortgage Rates Are Stabilizing – How That Helps Today’s Buyers

Over the past few years, affordability has been the biggest challenge for homebuyers. Between rapidly rising home prices and higher mortgage rates, many have felt stuck between a rock and a hard place.

But, something pretty encouraging is happening. While affordability is still tight, mortgage rates have shown signs of stabilizing in recent months. And that may finally make it a bit easier to plan your move.

Mortgage Rates Have Stabilized – For Now

Over the past year, mortgage rates have had their share of ups and downs, making it tough for buyers to know what to expect. But recently, rates have started to level out and have settled into a more narrow range (see graph below):

As the graph shows, rates have stayed within that half-percentage-point since late last year. Yes, there’s been movement within that range, but wild swings and sudden ups and downs just haven’t been the story lately. And that’s a bigger deal than you may realize. As HousingWire explains:

“Analysts, economists and mortgage professionals are coining this quarter’s activity as one of the most “calm” periods for mortgage rates in recent memory.”

How This Helps Today’s Buyers

Let’s be real. Unpredictability makes it tough to plan ahead. When rates are bouncing around and making big jumps week to week, it’s easy to be intimidated. But with rates staying in a pretty steady range over the past several months, you have a clearer picture of what your potential monthly payment could look like. That makes moving feel less uncertain – and more doable.

So, stop waiting. And start planning. Even though rates may not be where you want them to be right now, they have been much less volatile for quite some time.

Will This Stability Last?

According to the experts, it looks like that stability might hang around for a bit. Rates may come down ever so slightly in the months ahead, but it’ll likely be a slow and mild change. As Danielle Hale, Chief Economist at Realtor.com, says:

“I expect a generally downward trend for rates this year, but at a slow enough pace that it might not be noticeable in any given month.”

So, if you’ve been holding out for the perfect mortgage rate, the best advice is to avoid trying to time the market. It may not look terribly different than the opportunity you already have in front of you. As Jeff Ostrowski, Housing Market Analyst at Bankrate, explains:

“Trying to time mortgage rates is really difficult. There’s no guarantee that rates are going to be any more favorable in three months or six months.”

And if we look at the latest expert forecasts that go out a bit further, even those tell much of the same story. Two out of the three projections say rates will still likely be in the mid-6% range by the end of 2026 (see graph below):

This puts today’s buyers in a much better spot. As Sam Khater, Chief Economist at Freddie Mac, explains:

“Mortgage rates have moved within a narrow range for the past few months . . . Rate stability, improving inventory and slower house price growth are an encouraging combination . . .”

Just remember, mortgage rates are still going to react to changing economic conditions, inflation, and more – and that means they could shift again. But right now, you’ve got more predictability, and that means more opportunity, too.

While affordability is still a challenge, the market may be offering a bit more stability – and that makes planning your next move a lot easier.

Let’s connect if you want to run the numbers and see what a monthly payment would look like in today’s market. That way you can stop waiting and start planning.

Read More About:

Mortgage Rates Are Stabilizing – How That Helps Today’s Buyers

The Winds Are Shifting: A New Era in Homebuying

For the last several years, the path to Buying A Home has felt like crossing a rickety bridge in a storm—high home prices, relentless interest rates, and a market teetering on unpredictability. But something’s changed. The gales have calmed, and the landscape, while not perfect, is more navigable.

Welcome to the calm period for mortgage rates.

It’s not just a breather—it’s a beacon. After months of economic unrest and price frenzy, Mortgage Rates Are Stabilizing, offering homebuyers a much-needed moment of clarity. And when you look beneath the surface, this pause could very well be the market opportunity smart buyers have been waiting for.

Why Mortgage Rate Stability Changes Everything

A year ago, watching rate fluctuations was like tracking a wildfire—unpredictable, fast-moving, and downright stressful. But now, we’re seeing Mortgage Rates settle into a narrow range, hovering with more consistency.

This newfound rate stability does something remarkable: it creates predictability in rates. And with that predictability comes power. Buyers can finally sit down, crunch numbers, and plan with a real sense of control.

Whether it’s calculating a monthly payment or analyzing mortgage forecasts, the game has changed. Less volatility. More strategy.

As noted by HousingWire, this isn’t just a short break from chaos—it’s one of the most composed chapters in mortgage rate history:

“Analysts, economists, and Mortgage Professionals are coining this quarter’s activity as one of the most calm periods for mortgage rates in recent memory.”

Let that sink in. This isn’t just relief—it’s renaissance.

How Buyers Benefit From Rate Stability

When interest rates were leaping like acrobats from week to week, real estate planning became an exercise in futility. Buyers were paralyzed by the fear of locking in a loan one day, only to see better numbers the next. That uncertainty killed momentum.

Now, with Stabilizing mortgage rates, the fog is lifting.

The steadiness of todays market gives buyers something critical: confidence. They’re no longer scrambling to “catch the dip” or worried about making a move in a hyper-volatile environment. The numbers may not be at historic lows, but they’re predictable—and that alone can swing the scales from hesitation to action.

Here’s what’s happening now:

Homebuyers are better able to estimate what their monthly payment will look like.

Lenders are providing more reliable quotes and timeframes.

Realtors and financial advisors can strategize effectively with clients.

And in places like Florida? The search for Affordable West Palm Beach home loans is getting a boost from lenders encouraged by rate steadiness.

Rebuilding Affordability in a Shifting Market

Yes, affordability is still a hurdle. But let’s look at the math.

Pairing Mortgage Rates that are no longer skyrocketing with signs of slower house price growth means that buyers are getting closer to a sustainable balance between income and housing costs.

Housing affordability is inching back into the conversation—and not just nationally. In hotspots like South Florida, the door is cracking open wider. With the help of a West Palm Beach mortgage broker, buyers are finding real options to make ownership attainable.

Tools like West Palm Beach mortgage calculators are turning dreams into digits. Buyers can now project costs with a level of accuracy not possible six months ago. That’s power. That’s progress.

Economic Conditions and the Bigger Picture

Let’s not ignore the elephant in the room: the macro landscape. Economic conditions remain in flux. Inflation has cooled slightly but still hovers above comfort levels. Wage growth is real but uneven. The Fed still watches from the wings.

Still, with all these variables, the latest expert forecasts point to continued stability—or even a slow rate change downward.

According to Realtor.com’s Chief Economist, Danielle Hale:

“I expect a generally downward trend for rates this year, but at a slow enough pace that it might not be noticeable in any given month.”

That’s not fireworks. That’s a gentle, almost imperceptible current—exactly the kind of subtle momentum that seasoned buyers capitalize on.

Stop Trying To Time the Market

The idea of waiting for the perfect mortgage rate? It’s time to shelve that strategy.

Jeff Ostrowski, Housing Market Analyst at Bankrate, cuts to the chase:

“Trying to time the market is really difficult. There’s no guarantee that rates are going to be any more favorable in three months or six months.”

He’s right. The smart money doesn’t wait for magic. It moves with intention in the window that exists now. And that window—while not a grand opening—is a clear one.

Inventory Is No Longer the Villain

Here’s another plot twist: Inventory is rising.

Yes, the ghost town that was the housing shelf in 2022 is slowly restocking. Improving inventory levels are giving buyers more options—and more leverage. This combination of better supply and stabilized rates means negotiations are getting less cutthroat.

This shift is especially pronounced in cities with aggressive growth and strong loan infrastructure. In South Florida, buyers have a wider selection and access to more favorable lending tools like:

First time home buyer loans in West Palm Beach

West Palm Beach refinancing options

Local mortgage lenders in West Palm Beach

Mortgage preapproval in West Palm Beach

Even niche offerings through a Commercial mortgage broker in West Palm Beach

The doors aren’t just open—they’re being held wide.

A Spotlight on West Palm Beach

Let’s zero in on one market that’s benefiting greatly from this stability: West Palm Beach.

A region once infamous for bidding wars and razor-thin margins is now seeing a renaissance in buyer confidence. With Best mortgage rates in West Palm Beach holding steady, aspiring homeowners are finally finding their footing.

For those considering making their move, having a trusted West Palm Beach mortgage broker by your side is invaluable. From navigating West Palm Beach mortgage calculators to securing Property loan advice in West Palm Beach, the resources available today outpace what was accessible during the chaos of previous years.

And let’s not forget the magic of preapproval. A fast-track mortgage preapproval in West Palm Beach could be your golden ticket in a climate where timing and preparation matter more than ever.

Where We Go From Here

It’s tempting to get comfortable with the word “stable.” But Mortgage Professionals know better: markets shift, tides turn, and tranquility isn’t forever.

Mortgage Rates are still sensitive to broader economic conditions—especially if inflation takes another unexpected turn. But for now, the outlook remains cautiously optimistic.

Freddie Mac’s Chief Economist, Sam Khater, underscores this sentiment:

“Mortgage rates have moved within a narrow range for the past few months… Rate stability, improving inventory, and slower house price growth are an encouraging combination.”

Translation? Opportunity is no longer hypothetical—it’s here.

What To Watch For

If you’re still on the fence, keep your eyes on these key indicators:

Inflation trends and how they influence Fed policy

Changes in wage growth vs. home prices

Ongoing updates from expert projections and financial institutions

Local trends—especially in West Palm Beach, where lenders are uniquely positioned to offer regionalized insights

As Mortgage forecasts evolve, staying informed and working with localized experts—especially Local mortgage lenders in West Palm Beach—can give you an edge.

Making Your Move in Today’s Market

Whether you’re a first-time buyer, an investor, or just someone looking to put down roots, todays market offers clarity we haven’t seen in years.

And clarity is currency.

Let go of outdated expectations about 2% rates or once-in-a-lifetime deals. Instead, embrace the current climate for what it is: a season of strategy. Use tools. Ask questions. Leverage insights. Lean on pros like a Commercial mortgage broker in West Palm Beach if your plans include multi-unit or investment properties.

This isn’t about waiting for perfection. It’s about acting during the calm period for mortgage rates, when the waters are smooth enough to chart a real course forward.

Final Thought

Affordability is still a battle—but we’re no longer fighting blind.

With Stabilizing mortgage rates, more inventory, and actionable insights from the latest expert forecasts, this is no longer the treacherous terrain of last year. It’s a path with guardrails. A road with direction.

And in places like West Palm Beach, the combination of Affordable West Palm Beach home loans, smarter tools, and seasoned Mortgage Professionals means you’re not going it alone.

The time to move isn’t someday. It’s now.

And this time? The bridge looks a lot sturdier.

Read from source: “Click Me”

© Copyright 2025 EPIC! LOANS and its licensors | All Rights Reserved.

© Copyright 2025 EPIC! LOANS and its licensors | All Rights Reserved.