Welcome to the EPIC! Loans Blog

This blog is your best guide that is all about loans!

Welcome to the EPIC! Loans Blog

This blog is your best guide that is all about loans!

SUBSCRIBE TO OUR NEWSLETTER

Be the first one to read our blog articles by subscribing to our newsletter.

Should You Sell Now? The Lifestyle Factors That Could Tip the Scale

Should You Sell Now? The Lifestyle Factors That Could Tip the Scale

Are you on the fence about whether to sell your house now or hold off? It’s a common dilemma, but here’s a key point to consider: your lifestyle might be the biggest factor in your decision. While financial aspects are important, sometimes the personal motivations for moving are reason enough to make the leap sooner rather than later.

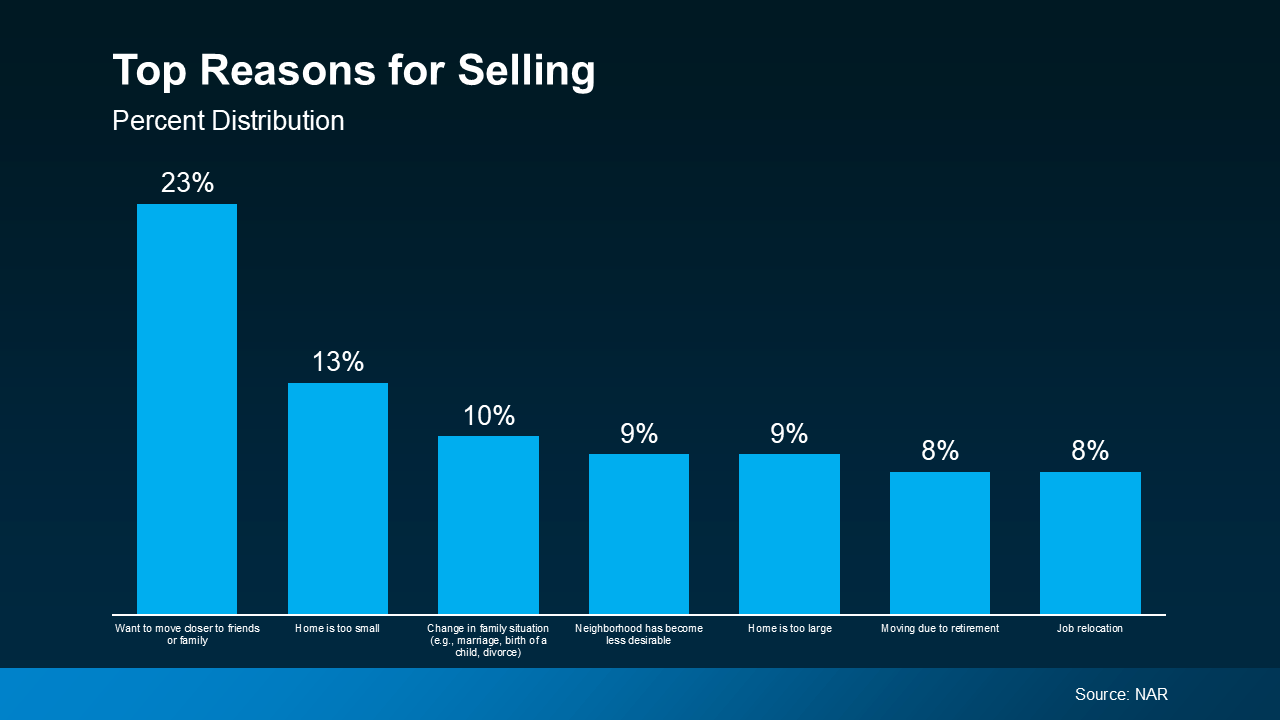

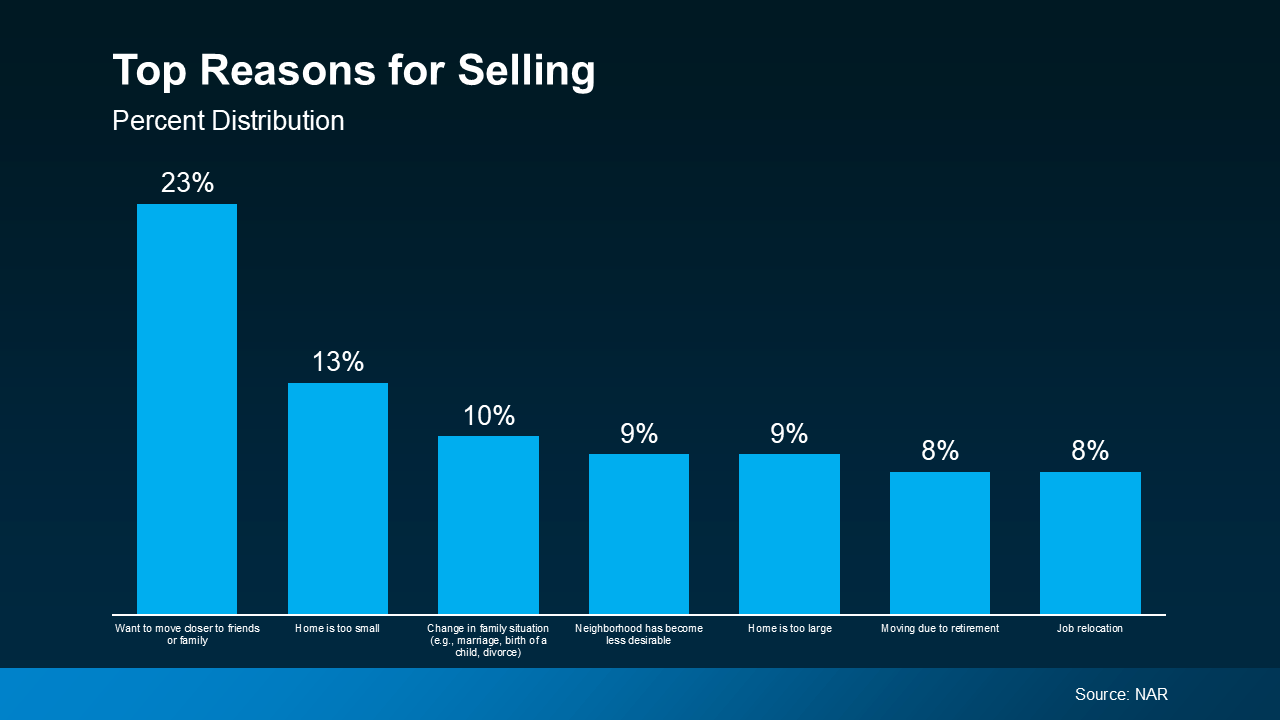

An annual report from the National Association of Realtors (NAR) offers insight into why homeowners like you chose to sell. All of the top reasons are related to life changes. As the graph below highlights:

As the visual shows, the biggest motivators were the desire to be closer to friends or family, outgrowing their current house, or experiencing a significant life change like getting married or having a baby. The need to downsize or relocate for work also made the list.

If you, like the homeowners in this report, find yourself needing features, space, or amenities your current home just can’t provide, it may be time to consider talking to a real estate agent about selling your house. Your needs matter. That agent will walk you through your options and what you can expect from today’s market, so you can make a confident decision based on what matters most to you and your loved ones.

Your agent will also be able to help you understand how much equity you have and how it can make moving to meet your changing needs that much easier. As Danielle Hale, Chief Economist at Realtor.com, explains:

“A consideration today’s homeowners should review is what their home equity picture looks like. With the typical home listing price up 40% from just five years ago, many home sellers are sitting on a healthy equity cushion. This means they are likely to walk away from a home sale with proceeds that they can use to offset the amount of borrowing needed for their next home purchase.”

Your lifestyle needs may be enough to motivate you to make a change. If you want help weighing the pros and cons of selling your house, let’s have a conversation.

Should You Sell Now? The Lifestyle Factors That Could Tip the Scale

Life is a series of crossroads, and for homeowners contemplating whether to sell now, the decision often lies at the intersection of lifestyle changes and market dynamics. When the walls of your beloved home start to feel a little too tight or too expansive, when your daily routine no longer suits your current surroundings, it’s time to reassess whether your house still fits your life.

So, should you sell your house? Let’s dive into the lifestyle factors that could tip the scale in favor of making that life-changing decision.

1. Your Home No Longer Suits Your Needs

Our needs change over time, and our homes need to keep up. Maybe you’ve had a life-altering event like welcoming a new family member, or perhaps the kids have flown the nest, leaving empty rooms and quiet spaces behind. Downsizing or upsizing—whichever direction your life is pulling you—might necessitate a change.

Downsizing for a Simpler Life

If the upkeep of your current home feels like a chore or the idea of simplifying your life is becoming increasingly appealing, downsize might be the word that rings in your ears. When you downsize, you reduce not just your living space but also the time and effort needed to maintain it. Downsizing can free up equity tied in your home, allowing you to live more comfortably while you plan for your future.

Upsizing for a Growing Family

On the flip side, upsizing might be on the horizon if you’re growing your family or welcoming elderly relatives into your home. It’s easy to outgrow a space that once seemed perfect when your lifestyle demands more room to spread out. In this scenario, selling your house could be a strategic move to find a home that better meets your expanding needs.

2. The Market is in Your Favor

Timing is everything when it comes to home sellers, and today’s market can be a powerful motivator. If the housing market in your area is booming, your home listing might attract significant interest. Demand is high, and inventory is low, giving sellers the upper hand. But how do you know if it’s the right time to sell now?

Healthy Equity: The Financial Advantage

If you’ve built up significant home equity, selling in a hot market could allow you to maximize your returns. Equity is the difference between what you owe on your mortgage and the current market value of your home. Having healthy equity means you stand to make a profit when you sell, which can be used to fund your next home purchase or other life ventures. It’s like cashing in on your investment at just the right moment.

3. Relocating for a New Adventure

Sometimes, the call of a new city or a fresh start is too loud to ignore. Whether it’s for a new job, to be closer to family, or simply a desire for a change of scenery, relocate is often a key lifestyle factor in deciding to sell your house. Moving to a different state or even a different country is a bold decision, but it can offer exciting opportunities that are worth the upheaval.

West Palm Beach: The Draw of the Sunshine State

If your heart is pulling you towards the warmth and vibrancy of Florida, particularly the scenic coastlines of West Palm Beach, then you’re not alone. West Palm Beach is a hotspot for both first-time buyers and seasoned home sellers. Whether you’re eyeing a luxury condo overlooking the water or a cozy bungalow nestled in a quiet neighborhood, selling your current home to make this dream a reality could be the next big step in your life journey.

When considering such a relocation, it’s essential to connect with a West Palm Beach mortgage broker. They can guide you through the maze of Affordable West Palm Beach home loans, helping you secure the best mortgage rates in West Palm Beach. If you’re a first-time home buyer, a local expert can also introduce you to specialized programs like First time home buyer loans in West Palm Beach.

Refinancing Options for West Palm Beach Homes

Perhaps you’re thinking of buying a second property in West Palm Beach without letting go of your current home. If so, West Palm Beach refinancing options can help make that dream a reality. Local mortgage lenders in West Palm Beach can assist in tailoring a refinance plan to suit your goals, enabling you to tap into your home’s equity or secure a lower interest rate.

Before you make any final decisions, be sure to use West Palm Beach mortgage calculators. These handy tools can help you estimate your monthly payments and overall costs, giving you a clearer financial picture.

4. Health and Well-Being

Your health and well-being can be a major driver behind the decision to sell your house. Whether it’s for easier access to medical facilities, a more temperate climate, or to be closer to a support network, prioritizing your health is an undeniable reason to consider moving.

Access to Healthcare and Wellness

Proximity to quality healthcare might become more important as you age or if a health condition requires ongoing care. If your current location doesn’t offer easy access to the medical services you need, relocating to a more suitable area could improve your quality of life.

Climate and Comfort

For some, the weather is more than just a backdrop to their day; it’s a critical factor in how they feel. Warmer climates can be more forgiving on joints, while drier climates might alleviate respiratory issues. If you’re looking for year-round sunshine and balmy breezes, West Palm Beach offers an enviable climate that could significantly boost your well-being.

5. Career and Work-Life Balance

Today’s working environment has changed dramatically, with more people working from home or embracing remote work. Your home has become not just a place to live but also a place to work, so if your current setup isn’t conducive to productivity, it might be time for a change.

Home Office Space

A cramped or poorly lit workspace can affect your productivity and overall job satisfaction. If your current home doesn’t offer adequate space for a home office, selling your house and moving to a property with a designated office or extra room could enhance your work-life balance. With the lines between home and work blurring, the functionality of your home is more critical than ever.

Commute Considerations

On the other hand, if you’re no longer tied to a physical office, you have the freedom to live anywhere. This newfound flexibility could allow you to move to a location that better suits your lifestyle without the concern of a long commute. Whether you’re drawn to the vibrant city life or a more tranquil rural setting, selling your home and relocating could offer you the ideal balance between work and personal life.

6. Financial Position and Future Planning

Your financial situation is another key factor in deciding whether to sell now. Beyond home equity, it’s crucial to consider your long-term financial goals. Are you nearing retirement? Or perhaps you’re looking to free up funds to invest in a new business venture?

Cashing Out for Retirement

If you’re approaching retirement, selling your home could allow you to downsize and use the proceeds to supplement your retirement savings. Alternatively, you could sell a larger home to move into a low-maintenance property that requires less upkeep, giving you more freedom to enjoy your golden years.

Investing in New Ventures

For those with an entrepreneurial spirit, selling your house might free up the capital needed to invest in a new business or pursue other financial opportunities. By cashing in on the equity in your home, you could fund your next big idea without taking on additional debt.

7. Personal Fulfillment and Happiness

At the end of the day, the decision to sell your house often comes down to personal fulfillment. If your current home no longer brings you joy or aligns with your lifestyle, it might be time for a change. Your home should be a place of comfort and contentment—a sanctuary where you can thrive.

The Emotional Connection

It’s important to acknowledge the emotional connection you have to your home. Selling can be a bittersweet process, especially if your house is filled with years of memories. But sometimes, embracing change is the best way to open yourself up to new experiences and opportunities.

Seeking New Horizons

Perhaps you’ve always dreamed of living in a different part of the world, or maybe you’re simply craving a fresh start. Whatever the reason, selling your home can be the catalyst for a new chapter in your life. Don’t be afraid to pursue what makes you happy, even if it means letting go of the familiar.

8. The Expertise of a Real Estate Agent

Navigating the complexities of selling a home requires expertise and guidance. Partnering with a seasoned Real Estate Agent can make the process smoother and more manageable. A good agent will help you weigh the pros and cons of selling your house, guide you through the pricing and negotiation process, and ensure that your home listing stands out in today’s market.

In West Palm Beach, working with a Commercial mortgage broker in West Palm Beach or seeking Property loan advice in West Palm Beach can also be a game-changer, especially if you’re considering purchasing a commercial property. A local expert will have the knowledge and connections to help you make the most informed decisions.

Mortgage Preapproval and Beyond

Before you make a move, securing Mortgage preapproval in West Palm Beach is a smart step. This will give you a clear idea of what you can afford and allow you to act quickly when you find the perfect property. With the help of local mortgage lenders in West Palm Beach, you can streamline the process and avoid any last-minute surprises.

Conclusion: Is It Time to Sell Your House?

Deciding whether to sell your house is a deeply personal choice, influenced by a mix of lifestyle factors, market conditions, and financial goals. Whether you’re drawn by the allure of downsizing, the need for a larger space, or the opportunity to relocate, the decision to sell should ultimately align with your long-term vision for your life.

By evaluating the key lifestyle factors—your current needs, financial position, career goals, and personal happiness—you can make a well-informed decision that supports your future. And with the right team of experts, including a knowledgeable Real Estate Agent and a savvy West Palm Beach mortgage broker, you’ll be well-positioned to navigate the journey ahead with confidence.

9. Timing and the Art of Selling

When considering if you should sell now, one undeniable factor is timing. The housing market is constantly fluctuating, and while there may never be a “perfect” time to sell, there are certainly moments when it’s more advantageous. Knowing when to strike can make all the difference in maximizing your return on investment.

Seasonal Trends

Real estate traditionally follows a seasonal pattern, with spring and early summer being the most active periods for buying and selling. Families often prefer to move during these months to avoid disrupting the school year. If you’re selling during these peak times, you may benefit from increased buyer interest and potentially higher offers. However, this also means more competition. Your home listing needs to stand out, which is where the expertise of a Real Estate Agent becomes invaluable.

On the flip side, selling in the fall or winter can mean fewer buyers, but it also means less competition. If you’re not in a rush, waiting for the right moment could allow you to capitalize on a less saturated market. Additionally, serious buyers—those motivated to find a home before the new year—are often looking during these quieter months.

Market Trends and Economic Factors

Today’s market is shaped not just by seasonal trends but by broader economic forces. Interest rates, inflation, and economic confidence all play a role in the housing market. When interest rates are low, buyers have greater purchasing power, which can drive up demand and home prices. However, if interest rates are on the rise, buyers might become more hesitant, leading to a cooling market.

Understanding how these factors interplay is essential. If you’re considering West Palm Beach refinancing options or you’re in the market for the best mortgage rates in West Palm Beach, timing your sale with favorable economic conditions can put you in a strong position financially. Consulting with a West Palm Beach mortgage broker or exploring Property loan advice in West Palm Beach can offer insights that guide your decision-making.

Local Market Conditions

Every housing market is local, and what’s happening in one part of the country may not be happening in another. If your area is experiencing a real estate boom, that might tip the scales in favor of selling sooner rather than later. On the other hand, if the market is sluggish, waiting for an upswing might be wise. Working closely with a Real Estate Agent who knows the intricacies of your local market is key. They can provide detailed insights into current trends and help you decide the optimal time to list your home.

10. Emotional Readiness: Are You Ready to Move On?

Selling your home isn’t just a financial decision—it’s an emotional one too. Your home is more than just four walls; it’s where memories were made, where you’ve celebrated milestones, and where you’ve found comfort. Letting go of that connection can be challenging. But emotional readiness is a crucial factor in deciding whether to sell now.

A Fresh Start

For some, selling is about closing one chapter and starting another. Maybe you’re moving on after a significant life event like a divorce, the passing of a loved one, or simply a change in life’s direction. A new home can symbolize a fresh start—a blank canvas where new memories can be created. If you find yourself feeling more excitement than sadness at the thought of moving, that’s a good indicator that you’re emotionally ready.

Sentimental Value vs. Practicality

It’s easy to get caught up in the sentimental value of a home, but it’s important to balance that with practicality. If your current home no longer serves your needs, holding onto it for purely emotional reasons might not be the best choice. Instead, focus on the possibilities that a new home could offer—whether that’s a more convenient location, a better layout, or just a home that better suits your lifestyle.

11. Exploring Your Options: What’s Next?

Once you’ve made the decision to sell your house, the next step is planning your future. Whether you’re looking to buy another property, rent, or travel, having a clear plan will make the transition smoother.

Renting vs. Buying

If you’re not ready to jump back into homeownership, renting can be a flexible option. It allows you to explore different areas or downsize without the long-term commitment of owning another property. This is especially beneficial if you’re relocating to a new city and want to get a feel for the area before making a permanent move.

Alternatively, if buying another home is in your future, having your finances in order is crucial. Whether you’re moving to West Palm Beach or another destination, you’ll want to explore Mortgage preapproval in West Palm Beach or consult with Local mortgage lenders in West Palm Beach. They can help you understand what you qualify for and what you can afford, ensuring that you’re prepared for your next home purchase.

Financial Flexibility

Selling your home can provide you with financial flexibility. If you’ve built up substantial equity, you may be able to fund your next move without taking on a new mortgage. Or, you might choose to put that money into investments, savings, or even a passion project you’ve always dreamed of pursuing. Having that liquidity can give you the freedom to make decisions that align with your broader life goals.

12. Conclusion: Making the Decision That’s Right for You

Deciding whether to sell your house is a major life choice, influenced by a blend of financial, emotional, and lifestyle factors. The key is to assess where you are in life and where you want to go next. Are you ready for a fresh start in a new home, or does staying put better align with your current needs and future plans?

Consider the state of today’s market, your home equity, and your emotional readiness. Evaluate the impact on your lifestyle—whether it’s downsizing for simplicity, upsizing for a growing family, or relocating for a new job or adventure. And don’t forget to lean on the expertise of professionals, from Real Estate Agents to West Palm Beach mortgage brokers, who can guide you through every step of the process.

Whatever you decide, remember that your home is ultimately an extension of your life. As your life evolves, so too should your living space. By carefully weighing your options and making a thoughtful decision, you can ensure that your home continues to be a place where you thrive.

Read from source: “Click Me”

Should You Sell Now? The Lifestyle Factors That Could Tip the Scale

Should You Sell Now? The Lifestyle Factors That Could Tip the Scale

Are you on the fence about whether to sell your house now or hold off? It’s a common dilemma, but here’s a key point to consider: your lifestyle might be the biggest factor in your decision. While financial aspects are important, sometimes the personal motivations for moving are reason enough to make the leap sooner rather than later.

An annual report from the National Association of Realtors (NAR) offers insight into why homeowners like you chose to sell. All of the top reasons are related to life changes. As the graph below highlights:

As the visual shows, the biggest motivators were the desire to be closer to friends or family, outgrowing their current house, or experiencing a significant life change like getting married or having a baby. The need to downsize or relocate for work also made the list.

If you, like the homeowners in this report, find yourself needing features, space, or amenities your current home just can’t provide, it may be time to consider talking to a real estate agent about selling your house. Your needs matter. That agent will walk you through your options and what you can expect from today’s market, so you can make a confident decision based on what matters most to you and your loved ones.

Your agent will also be able to help you understand how much equity you have and how it can make moving to meet your changing needs that much easier. As Danielle Hale, Chief Economist at Realtor.com, explains:

“A consideration today’s homeowners should review is what their home equity picture looks like. With the typical home listing price up 40% from just five years ago, many home sellers are sitting on a healthy equity cushion. This means they are likely to walk away from a home sale with proceeds that they can use to offset the amount of borrowing needed for their next home purchase.”

Your lifestyle needs may be enough to motivate you to make a change. If you want help weighing the pros and cons of selling your house, let’s have a conversation.

Should You Sell Now? The Lifestyle Factors That Could Tip the Scale

Life is a series of crossroads, and for homeowners contemplating whether to sell now, the decision often lies at the intersection of lifestyle changes and market dynamics. When the walls of your beloved home start to feel a little too tight or too expansive, when your daily routine no longer suits your current surroundings, it’s time to reassess whether your house still fits your life.

So, should you sell your house? Let’s dive into the lifestyle factors that could tip the scale in favor of making that life-changing decision.

1. Your Home No Longer Suits Your Needs

Our needs change over time, and our homes need to keep up. Maybe you’ve had a life-altering event like welcoming a new family member, or perhaps the kids have flown the nest, leaving empty rooms and quiet spaces behind. Downsizing or upsizing—whichever direction your life is pulling you—might necessitate a change.

Downsizing for a Simpler Life

If the upkeep of your current home feels like a chore or the idea of simplifying your life is becoming increasingly appealing, downsize might be the word that rings in your ears. When you downsize, you reduce not just your living space but also the time and effort needed to maintain it. Downsizing can free up equity tied in your home, allowing you to live more comfortably while you plan for your future.

Upsizing for a Growing Family

On the flip side, upsizing might be on the horizon if you’re growing your family or welcoming elderly relatives into your home. It’s easy to outgrow a space that once seemed perfect when your lifestyle demands more room to spread out. In this scenario, selling your house could be a strategic move to find a home that better meets your expanding needs.

2. The Market is in Your Favor

Timing is everything when it comes to home sellers, and today’s market can be a powerful motivator. If the housing market in your area is booming, your home listing might attract significant interest. Demand is high, and inventory is low, giving sellers the upper hand. But how do you know if it’s the right time to sell now?

Healthy Equity: The Financial Advantage

If you’ve built up significant home equity, selling in a hot market could allow you to maximize your returns. Equity is the difference between what you owe on your mortgage and the current market value of your home. Having healthy equity means you stand to make a profit when you sell, which can be used to fund your next home purchase or other life ventures. It’s like cashing in on your investment at just the right moment.

3. Relocating for a New Adventure

Sometimes, the call of a new city or a fresh start is too loud to ignore. Whether it’s for a new job, to be closer to family, or simply a desire for a change of scenery, relocate is often a key lifestyle factor in deciding to sell your house. Moving to a different state or even a different country is a bold decision, but it can offer exciting opportunities that are worth the upheaval.

West Palm Beach: The Draw of the Sunshine State

If your heart is pulling you towards the warmth and vibrancy of Florida, particularly the scenic coastlines of West Palm Beach, then you’re not alone. West Palm Beach is a hotspot for both first-time buyers and seasoned home sellers. Whether you’re eyeing a luxury condo overlooking the water or a cozy bungalow nestled in a quiet neighborhood, selling your current home to make this dream a reality could be the next big step in your life journey.

When considering such a relocation, it’s essential to connect with a West Palm Beach mortgage broker. They can guide you through the maze of Affordable West Palm Beach home loans, helping you secure the best mortgage rates in West Palm Beach. If you’re a first-time home buyer, a local expert can also introduce you to specialized programs like First time home buyer loans in West Palm Beach.

Refinancing Options for West Palm Beach Homes

Perhaps you’re thinking of buying a second property in West Palm Beach without letting go of your current home. If so, West Palm Beach refinancing options can help make that dream a reality. Local mortgage lenders in West Palm Beach can assist in tailoring a refinance plan to suit your goals, enabling you to tap into your home’s equity or secure a lower interest rate.

Before you make any final decisions, be sure to use West Palm Beach mortgage calculators. These handy tools can help you estimate your monthly payments and overall costs, giving you a clearer financial picture.

4. Health and Well-Being

Your health and well-being can be a major driver behind the decision to sell your house. Whether it’s for easier access to medical facilities, a more temperate climate, or to be closer to a support network, prioritizing your health is an undeniable reason to consider moving.

Access to Healthcare and Wellness

Proximity to quality healthcare might become more important as you age or if a health condition requires ongoing care. If your current location doesn’t offer easy access to the medical services you need, relocating to a more suitable area could improve your quality of life.

Climate and Comfort

For some, the weather is more than just a backdrop to their day; it’s a critical factor in how they feel. Warmer climates can be more forgiving on joints, while drier climates might alleviate respiratory issues. If you’re looking for year-round sunshine and balmy breezes, West Palm Beach offers an enviable climate that could significantly boost your well-being.

5. Career and Work-Life Balance

Today’s working environment has changed dramatically, with more people working from home or embracing remote work. Your home has become not just a place to live but also a place to work, so if your current setup isn’t conducive to productivity, it might be time for a change.

Home Office Space

A cramped or poorly lit workspace can affect your productivity and overall job satisfaction. If your current home doesn’t offer adequate space for a home office, selling your house and moving to a property with a designated office or extra room could enhance your work-life balance. With the lines between home and work blurring, the functionality of your home is more critical than ever.

Commute Considerations

On the other hand, if you’re no longer tied to a physical office, you have the freedom to live anywhere. This newfound flexibility could allow you to move to a location that better suits your lifestyle without the concern of a long commute. Whether you’re drawn to the vibrant city life or a more tranquil rural setting, selling your home and relocating could offer you the ideal balance between work and personal life.

6. Financial Position and Future Planning

Your financial situation is another key factor in deciding whether to sell now. Beyond home equity, it’s crucial to consider your long-term financial goals. Are you nearing retirement? Or perhaps you’re looking to free up funds to invest in a new business venture?

Cashing Out for Retirement

If you’re approaching retirement, selling your home could allow you to downsize and use the proceeds to supplement your retirement savings. Alternatively, you could sell a larger home to move into a low-maintenance property that requires less upkeep, giving you more freedom to enjoy your golden years.

Investing in New Ventures

For those with an entrepreneurial spirit, selling your house might free up the capital needed to invest in a new business or pursue other financial opportunities. By cashing in on the equity in your home, you could fund your next big idea without taking on additional debt.

7. Personal Fulfillment and Happiness

At the end of the day, the decision to sell your house often comes down to personal fulfillment. If your current home no longer brings you joy or aligns with your lifestyle, it might be time for a change. Your home should be a place of comfort and contentment—a sanctuary where you can thrive.

The Emotional Connection

It’s important to acknowledge the emotional connection you have to your home. Selling can be a bittersweet process, especially if your house is filled with years of memories. But sometimes, embracing change is the best way to open yourself up to new experiences and opportunities.

Seeking New Horizons

Perhaps you’ve always dreamed of living in a different part of the world, or maybe you’re simply craving a fresh start. Whatever the reason, selling your home can be the catalyst for a new chapter in your life. Don’t be afraid to pursue what makes you happy, even if it means letting go of the familiar.

8. The Expertise of a Real Estate Agent

Navigating the complexities of selling a home requires expertise and guidance. Partnering with a seasoned Real Estate Agent can make the process smoother and more manageable. A good agent will help you weigh the pros and cons of selling your house, guide you through the pricing and negotiation process, and ensure that your home listing stands out in today’s market.

In West Palm Beach, working with a Commercial mortgage broker in West Palm Beach or seeking Property loan advice in West Palm Beach can also be a game-changer, especially if you’re considering purchasing a commercial property. A local expert will have the knowledge and connections to help you make the most informed decisions.

Mortgage Preapproval and Beyond

Before you make a move, securing Mortgage preapproval in West Palm Beach is a smart step. This will give you a clear idea of what you can afford and allow you to act quickly when you find the perfect property. With the help of local mortgage lenders in West Palm Beach, you can streamline the process and avoid any last-minute surprises.

Conclusion: Is It Time to Sell Your House?

Deciding whether to sell your house is a deeply personal choice, influenced by a mix of lifestyle factors, market conditions, and financial goals. Whether you’re drawn by the allure of downsizing, the need for a larger space, or the opportunity to relocate, the decision to sell should ultimately align with your long-term vision for your life.

By evaluating the key lifestyle factors—your current needs, financial position, career goals, and personal happiness—you can make a well-informed decision that supports your future. And with the right team of experts, including a knowledgeable Real Estate Agent and a savvy West Palm Beach mortgage broker, you’ll be well-positioned to navigate the journey ahead with confidence.

9. Timing and the Art of Selling

When considering if you should sell now, one undeniable factor is timing. The housing market is constantly fluctuating, and while there may never be a “perfect” time to sell, there are certainly moments when it’s more advantageous. Knowing when to strike can make all the difference in maximizing your return on investment.

Seasonal Trends

Real estate traditionally follows a seasonal pattern, with spring and early summer being the most active periods for buying and selling. Families often prefer to move during these months to avoid disrupting the school year. If you’re selling during these peak times, you may benefit from increased buyer interest and potentially higher offers. However, this also means more competition. Your home listing needs to stand out, which is where the expertise of a Real Estate Agent becomes invaluable.

On the flip side, selling in the fall or winter can mean fewer buyers, but it also means less competition. If you’re not in a rush, waiting for the right moment could allow you to capitalize on a less saturated market. Additionally, serious buyers—those motivated to find a home before the new year—are often looking during these quieter months.

Market Trends and Economic Factors

Today’s market is shaped not just by seasonal trends but by broader economic forces. Interest rates, inflation, and economic confidence all play a role in the housing market. When interest rates are low, buyers have greater purchasing power, which can drive up demand and home prices. However, if interest rates are on the rise, buyers might become more hesitant, leading to a cooling market.

Understanding how these factors interplay is essential. If you’re considering West Palm Beach refinancing options or you’re in the market for the best mortgage rates in West Palm Beach, timing your sale with favorable economic conditions can put you in a strong position financially. Consulting with a West Palm Beach mortgage broker or exploring Property loan advice in West Palm Beach can offer insights that guide your decision-making.

Local Market Conditions

Every housing market is local, and what’s happening in one part of the country may not be happening in another. If your area is experiencing a real estate boom, that might tip the scales in favor of selling sooner rather than later. On the other hand, if the market is sluggish, waiting for an upswing might be wise. Working closely with a Real Estate Agent who knows the intricacies of your local market is key. They can provide detailed insights into current trends and help you decide the optimal time to list your home.

10. Emotional Readiness: Are You Ready to Move On?

Selling your home isn’t just a financial decision—it’s an emotional one too. Your home is more than just four walls; it’s where memories were made, where you’ve celebrated milestones, and where you’ve found comfort. Letting go of that connection can be challenging. But emotional readiness is a crucial factor in deciding whether to sell now.

A Fresh Start

For some, selling is about closing one chapter and starting another. Maybe you’re moving on after a significant life event like a divorce, the passing of a loved one, or simply a change in life’s direction. A new home can symbolize a fresh start—a blank canvas where new memories can be created. If you find yourself feeling more excitement than sadness at the thought of moving, that’s a good indicator that you’re emotionally ready.

Sentimental Value vs. Practicality

It’s easy to get caught up in the sentimental value of a home, but it’s important to balance that with practicality. If your current home no longer serves your needs, holding onto it for purely emotional reasons might not be the best choice. Instead, focus on the possibilities that a new home could offer—whether that’s a more convenient location, a better layout, or just a home that better suits your lifestyle.

11. Exploring Your Options: What’s Next?

Once you’ve made the decision to sell your house, the next step is planning your future. Whether you’re looking to buy another property, rent, or travel, having a clear plan will make the transition smoother.

Renting vs. Buying

If you’re not ready to jump back into homeownership, renting can be a flexible option. It allows you to explore different areas or downsize without the long-term commitment of owning another property. This is especially beneficial if you’re relocating to a new city and want to get a feel for the area before making a permanent move.

Alternatively, if buying another home is in your future, having your finances in order is crucial. Whether you’re moving to West Palm Beach or another destination, you’ll want to explore Mortgage preapproval in West Palm Beach or consult with Local mortgage lenders in West Palm Beach. They can help you understand what you qualify for and what you can afford, ensuring that you’re prepared for your next home purchase.

Financial Flexibility

Selling your home can provide you with financial flexibility. If you’ve built up substantial equity, you may be able to fund your next move without taking on a new mortgage. Or, you might choose to put that money into investments, savings, or even a passion project you’ve always dreamed of pursuing. Having that liquidity can give you the freedom to make decisions that align with your broader life goals.

12. Conclusion: Making the Decision That’s Right for You

Deciding whether to sell your house is a major life choice, influenced by a blend of financial, emotional, and lifestyle factors. The key is to assess where you are in life and where you want to go next. Are you ready for a fresh start in a new home, or does staying put better align with your current needs and future plans?

Consider the state of today’s market, your home equity, and your emotional readiness. Evaluate the impact on your lifestyle—whether it’s downsizing for simplicity, upsizing for a growing family, or relocating for a new job or adventure. And don’t forget to lean on the expertise of professionals, from Real Estate Agents to West Palm Beach mortgage brokers, who can guide you through every step of the process.

Whatever you decide, remember that your home is ultimately an extension of your life. As your life evolves, so too should your living space. By carefully weighing your options and making a thoughtful decision, you can ensure that your home continues to be a place where you thrive.

Read from source: “Click Me”

© Copyright 2025 EPIC! LOANS and its licensors | All Rights Reserved.

© Copyright 2025 EPIC! LOANS and its licensors | All Rights Reserved.