Welcome to the EPIC! Loans Blog

This blog is your best guide that is all about loans!

Welcome to the EPIC! Loans Blog

This blog is your best guide that is all about loans!

SUBSCRIBE TO OUR NEWSLETTER

Be the first one to read our blog articles by subscribing to our newsletter.

The Truth About Where Home Prices Are Heading

The Truth About Where Home Prices Are Heading

There are plenty of headlines these days calling for a housing market crash. But the truth is, they’re not telling the full story. Here’s what’s actually happening, and what the experts project for home prices over the next 5 years. And spoiler alert – it’s not a crash.

Yes, in some local markets, prices are flattening or even dipping slightly this year as more homes hit the market. That’s normal with rising inventory. But the bigger picture is what really matters, and it’s far less dramatic than what the doom-and-gloom headlines suggest. Here’s why.

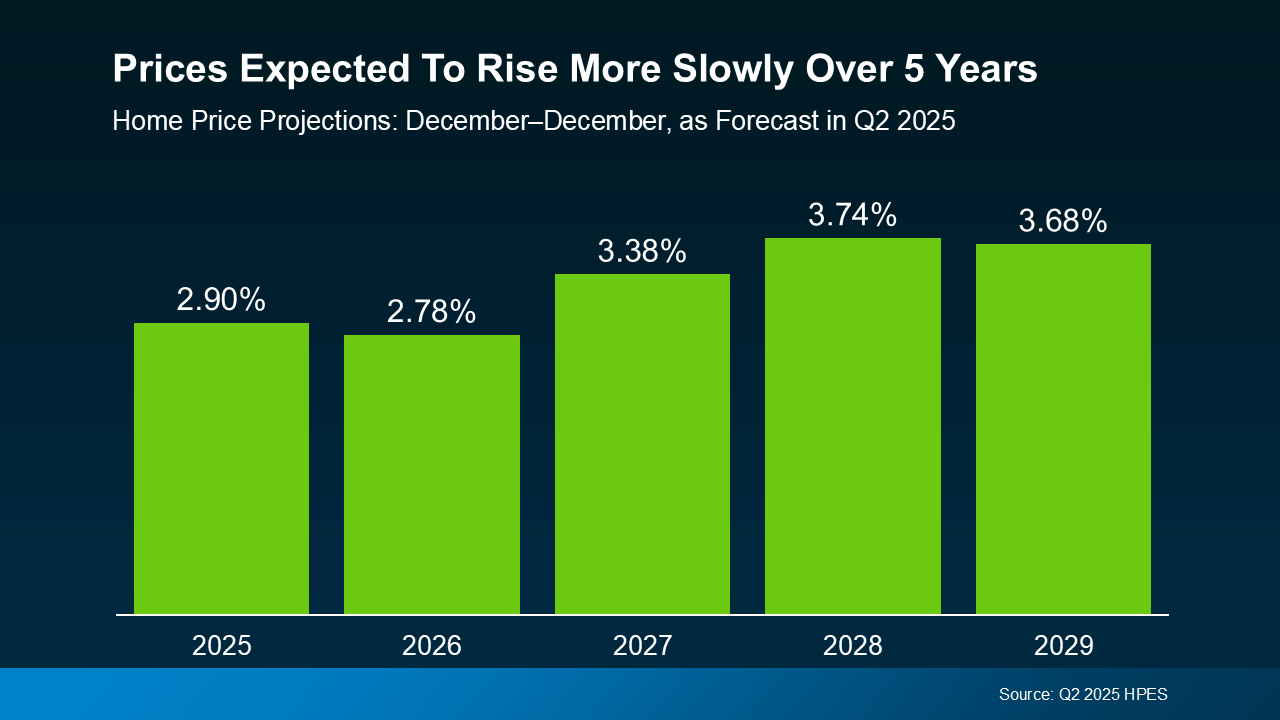

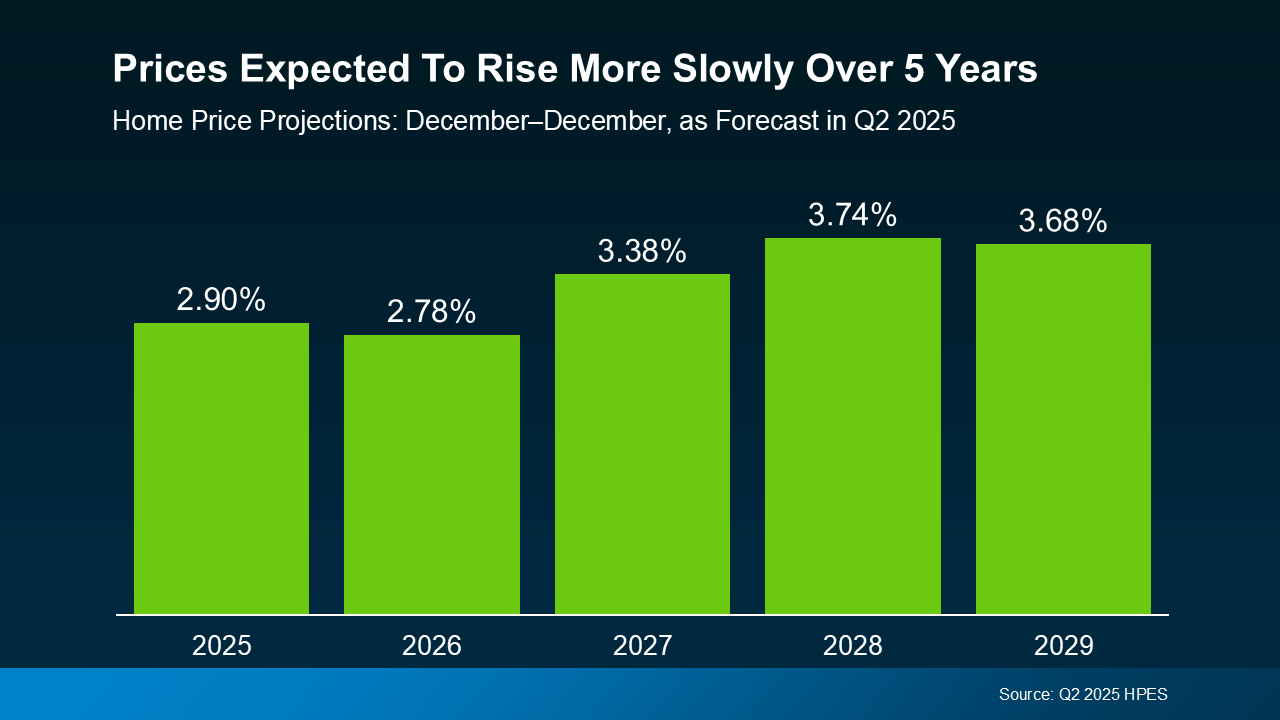

Over 100 leading housing market experts were surveyed in the latest Home Price Expectations Survey (HPES) from Fannie Mae. Their collective forecast shows prices are projected to keep rising over the next 5 years, just at a slower, healthier pace than what we’ve seen more recently. And that kind of steady, sustainable growth should be one factor to help ease your fears about the years ahead (see graph below):

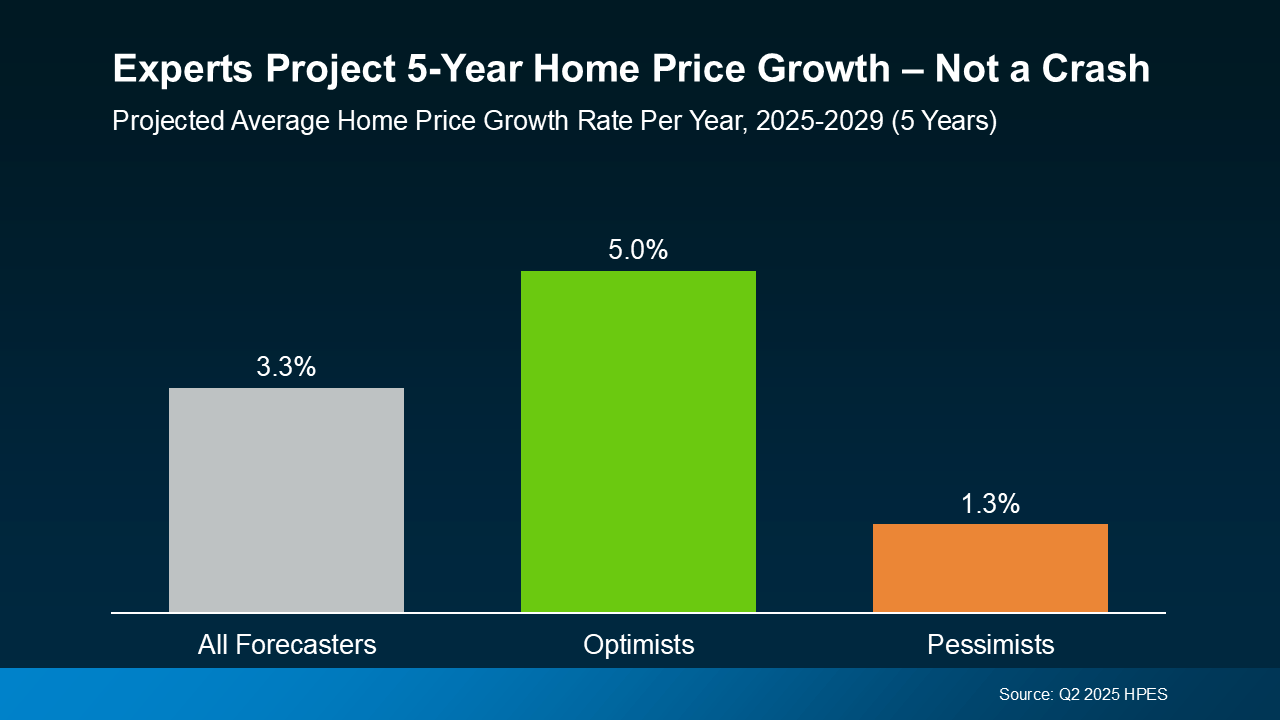

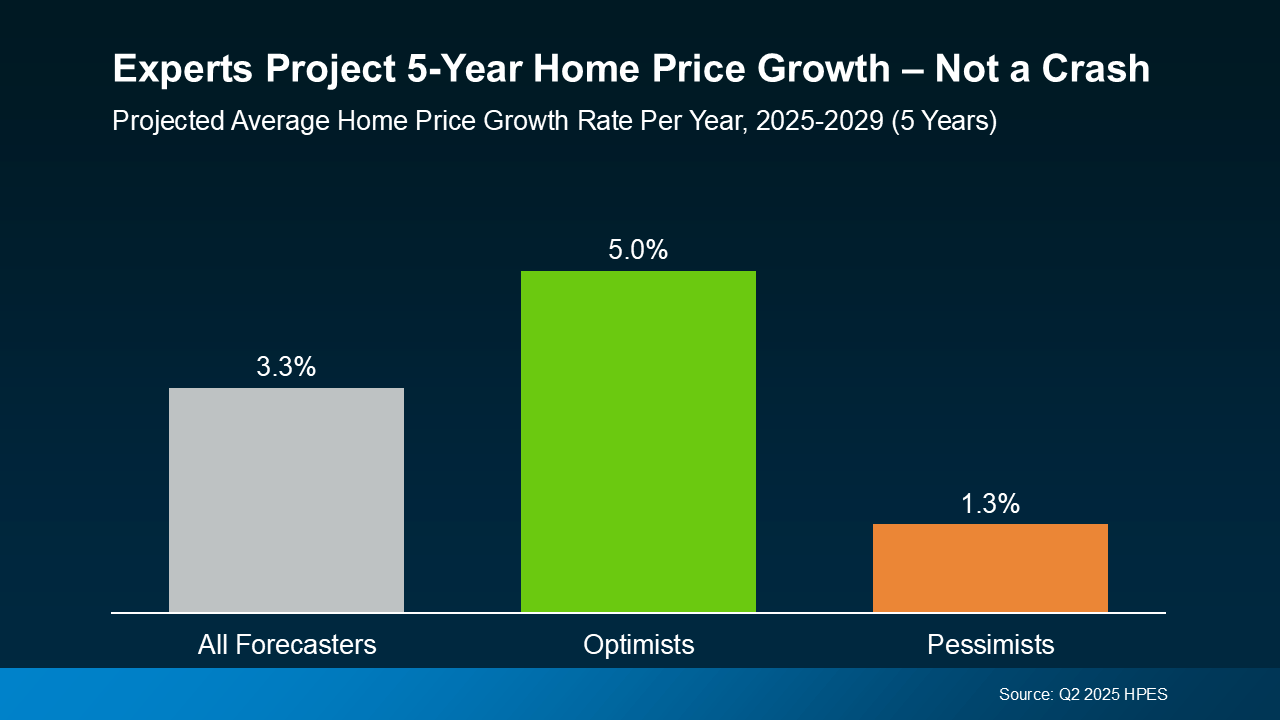

And if you take a look at how the various experts responded within the survey, they fall into three main categories: those that were most optimistic about the forecast, most pessimistic, and the overall average outlook.

Here’s what the breakdown shows:

The average projection is about 3.3% price growth per year, through 2029.

The optimists see growth closer to 5.0% per year.

The pessimists still forecast about 1.3% growth per year.

Do they all agree on the same number? Of course not. But here’s the key takeaway: not one expert group is calling for a major national decline or a crash. Instead, they expect home prices to rise at a steady, more sustainable pace.

That’s much healthier for the market – and for you. Yes, some areas may see prices hold relatively flat or dip a bit in the short term, especially where inventory is on the rise. Others may appreciate faster than the national average because there are still fewer homes for sale than there are buyers trying to purchase them. But overall, more moderate price growth is cooling the rapid spikes we saw during the frenzy of the past few years.

And remember, even the most conservative experts still project prices will rise over the course of the next 5 years. That’s also because foreclosures are low, lending standards are in check, and homeowners have near record equity to boost the stability of the market. Together, those factors help prevent a wave of forced sales, like the kind that could drag prices down. So, if you’re waiting for a significant crash before you buy, you might be waiting quite a long time.

If you’ve been on the fence about your plans, now’s the time to get clarity. The market isn’t heading for a crash. It’s on track for steady, slow, long-term growth overall, with some regional ups and downs along the way.

Want to know what that means for our neighborhood? Because national trends set the tone, but what really matters is what’s happening in your zip code. Let’s have a quick conversation so you can see exactly what our local data means for you.

More About:

The Truth About Where Home Prices Are Heading

The whispers of a looming housing market crash are loud. Some media outlets love a headline that grabs attention, even if it means stirring up anxiety among buyers, sellers, and curious homeowners. But beneath the sensationalism lies a reality far more nuanced — and far less alarming.

The truth is: the real estate market is not spiraling into chaos. It’s recalibrating. It’s adjusting after years of frenzy, froth, and fire-hot home sales. And understanding where home prices are heading requires slicing through the noise and focusing on facts, data, and expert insight. Let’s dig in.

A Reset, Not a Reversal

Across many local markets, the story isn’t about decline — it’s about stabilization. After meteoric rises in home prices, we’re seeing a return to earth. But that’s not a crash. That’s not devastation. That’s a healthy breather.

Inventory is ticking upward as more homes hit the market, naturally creating some pressure. Prices in certain regions are holding steady or, in isolated cases, dipping slightly. But none of this signals a bursting bubble.

In fact, the most comprehensive gauge we have — the Home Price Expectations Survey (HPES) conducted by Fannie Mae — offers a clear lens into what hundreds of housing market experts anticipate.

The Numbers Tell the Story

More than 100 leading minds were polled in the latest HPES, and their forecast isn’t a doomsday scenario. It’s a blueprint for measured, predictable change:

The average projection suggests price growth of around 3.3% per year through 2029.

The optimistic camp forecasts closer to 5% annual growth.

Even the most conservative — that one expert group that always predicts the least — still sees around 1.3% yearly appreciation.

Not a single group projected a significant market crash. Not one. That alone speaks volumes.

Slow and Steady: Why That’s Good News

We’re exiting a period of erratic jumps and entering a chapter of moderate appreciation. It’s the kind of pace that allows market stability to thrive and buyers to plan wisely. For sellers, it brings assurance that home value isn’t disappearing overnight. And for the economy at large, it’s the goldilocks zone — not too hot, not too cold.

What’s driving this new balance?

Foreclosures remain historically low.

Lending standards are far stricter than the pre-2008 era.

Homeowners are sitting on record equity.

There’s no tsunami of forced sales looming.

In other words, the foundation is strong.

Regionally Speaking: Not One-Size-Fits-All

While the national conversation gives a broad overview, neighborhood trends are where the real stories live. In some local markets, especially those with surging inventory, prices might soften short-term. Elsewhere, demand is still far outpacing supply, keeping values elevated.

For example, in Florida’s prized southeast corridor, West Palm Beach is seeing intriguing movement. An influx of remote workers and relocating families is keeping the city’s real estate market vibrant.

Working with a West Palm Beach mortgage broker can unlock access to tailored lending options, especially if you’re exploring first time home buyer loans in West Palm Beach or seeking affordable West Palm Beach home loans that align with your long-term goals.

The Role of Equity and Why It Matters

Here’s the unshakeable truth: most homeowners today are not overleveraged. They’re not upside down. Thanks to years of rapid home price appreciation, they’re sitting on a cushion — sometimes a mountain — of equity.

This matters because in a downturn, equity acts like a shield. It prevents a spiral of forced sales and desperation listings. When people have options, the bottom doesn’t fall out.

Record equity levels across the nation are acting as an economic anchor. Add to that the fact that mortgage holders today mostly have ultra-low fixed rates, and there’s little incentive to sell under pressure.

What This Means for Buyers

Many are still trying to time the market, hoping a massive dip will deliver them a deal. But if you wait to buy, you may end up chasing an opportunity that never comes.

The current outlook calls for sustainable pace rather than spectacular gains. But here’s the twist: with home prices still inching upward, today’s prices could be tomorrow’s bargains.

That’s where mortgage preapproval in West Palm Beach becomes your advantage. It puts you ahead of casual lookers and positions you to act quickly when the right property hits.

Whether you’re curious about the best mortgage rates in West Palm Beach, exploring West Palm Beach refinancing options, or leveraging West Palm Beach mortgage calculators to plan your monthly payments, preparedness pays.

Don’t Overlook Commercial Opportunities

Residential housing isn’t the only story. Commercial mortgage broker in West Palm Beach services are also seeing upticks as investors hunt for income-generating properties. From mixed-use developments to hospitality revivals, there’s an undercurrent of movement in commercial real estate that signals long-term confidence.

Need property loan advice in West Palm Beach for an unconventional asset? Local expertise makes all the difference. And yes, it’s still possible to find attractive cap rates — if you know where to look.

A Word to Sellers

Thinking of listing? Now may be your window. Though appreciation is slowing, home values are still high compared to pre-pandemic levels. And buyers are adjusting to the “new normal” of interest rates.

In many local markets, properly priced homes are still moving quickly, especially if they’ve been well maintained and presented with care.

Work with local mortgage lenders in West Palm Beach to help your buyers navigate financing — and close with confidence. Consider offering assistance toward closing costs or interest rate buydowns to sweeten the deal in a shifting market.

The Market Isn’t Falling – It’s Evolving

The myth of an impending housing market crash persists. But data and expert consensus continuously refute it. Instead, what’s happening is a recalibration — a move from breakneck speed to strategic, forward-focused momentum.

Fannie Mae’s robust research, grounded in the insights of over 100 housing market experts, paints a clear path: slow and steady growth over the next five years. No freefall. No bubble burst.

For those in West Palm Beach, this means there’s still real opportunity. Whether you’re buying your first home, refinancing, investing, or simply staying informed, our local data matters most.

Bottom Line

The media may love a storm story, but this one’s mostly sunshine. Yes, there will be clouds. Some local markets may wobble. But overall, the direction is steady and upward. The foundation is sound. The professionals have spoken.

If you’re a first time home buyer in West Palm Beach, there’s no need to hesitate. If you’re considering refinancing options, now is the time to shop. If you’re wondering when the market will “bottom out,” you might be asking the wrong question.

Instead, ask this: Where do I want to be in five years? Because that’s the horizon the forecast is focused on — and it looks remarkably strong.

Ready to navigate this evolving landscape? Whether you’re after the best mortgage rates in West Palm Beach, need custom property loan advice, or want clarity on neighborhood trends, the tools and guidance are already within reach.

The truth about where home prices are heading? They’re not crashing. They’re cruising — and for those prepared, they’re creating opportunity.

Read from source: “Click Me”

The Truth About Where Home Prices Are Heading

The Truth About Where Home Prices Are Heading

There are plenty of headlines these days calling for a housing market crash. But the truth is, they’re not telling the full story. Here’s what’s actually happening, and what the experts project for home prices over the next 5 years. And spoiler alert – it’s not a crash.

Yes, in some local markets, prices are flattening or even dipping slightly this year as more homes hit the market. That’s normal with rising inventory. But the bigger picture is what really matters, and it’s far less dramatic than what the doom-and-gloom headlines suggest. Here’s why.

Over 100 leading housing market experts were surveyed in the latest Home Price Expectations Survey (HPES) from Fannie Mae. Their collective forecast shows prices are projected to keep rising over the next 5 years, just at a slower, healthier pace than what we’ve seen more recently. And that kind of steady, sustainable growth should be one factor to help ease your fears about the years ahead (see graph below):

And if you take a look at how the various experts responded within the survey, they fall into three main categories: those that were most optimistic about the forecast, most pessimistic, and the overall average outlook.

Here’s what the breakdown shows:

The average projection is about 3.3% price growth per year, through 2029.

The optimists see growth closer to 5.0% per year.

The pessimists still forecast about 1.3% growth per year.

Do they all agree on the same number? Of course not. But here’s the key takeaway: not one expert group is calling for a major national decline or a crash. Instead, they expect home prices to rise at a steady, more sustainable pace.

That’s much healthier for the market – and for you. Yes, some areas may see prices hold relatively flat or dip a bit in the short term, especially where inventory is on the rise. Others may appreciate faster than the national average because there are still fewer homes for sale than there are buyers trying to purchase them. But overall, more moderate price growth is cooling the rapid spikes we saw during the frenzy of the past few years.

And remember, even the most conservative experts still project prices will rise over the course of the next 5 years. That’s also because foreclosures are low, lending standards are in check, and homeowners have near record equity to boost the stability of the market. Together, those factors help prevent a wave of forced sales, like the kind that could drag prices down. So, if you’re waiting for a significant crash before you buy, you might be waiting quite a long time.

If you’ve been on the fence about your plans, now’s the time to get clarity. The market isn’t heading for a crash. It’s on track for steady, slow, long-term growth overall, with some regional ups and downs along the way.

Want to know what that means for our neighborhood? Because national trends set the tone, but what really matters is what’s happening in your zip code. Let’s have a quick conversation so you can see exactly what our local data means for you.

More About:

The Truth About Where Home Prices Are Heading

The whispers of a looming housing market crash are loud. Some media outlets love a headline that grabs attention, even if it means stirring up anxiety among buyers, sellers, and curious homeowners. But beneath the sensationalism lies a reality far more nuanced — and far less alarming.

The truth is: the real estate market is not spiraling into chaos. It’s recalibrating. It’s adjusting after years of frenzy, froth, and fire-hot home sales. And understanding where home prices are heading requires slicing through the noise and focusing on facts, data, and expert insight. Let’s dig in.

A Reset, Not a Reversal

Across many local markets, the story isn’t about decline — it’s about stabilization. After meteoric rises in home prices, we’re seeing a return to earth. But that’s not a crash. That’s not devastation. That’s a healthy breather.

Inventory is ticking upward as more homes hit the market, naturally creating some pressure. Prices in certain regions are holding steady or, in isolated cases, dipping slightly. But none of this signals a bursting bubble.

In fact, the most comprehensive gauge we have — the Home Price Expectations Survey (HPES) conducted by Fannie Mae — offers a clear lens into what hundreds of housing market experts anticipate.

The Numbers Tell the Story

More than 100 leading minds were polled in the latest HPES, and their forecast isn’t a doomsday scenario. It’s a blueprint for measured, predictable change:

The average projection suggests price growth of around 3.3% per year through 2029.

The optimistic camp forecasts closer to 5% annual growth.

Even the most conservative — that one expert group that always predicts the least — still sees around 1.3% yearly appreciation.

Not a single group projected a significant market crash. Not one. That alone speaks volumes.

Slow and Steady: Why That’s Good News

We’re exiting a period of erratic jumps and entering a chapter of moderate appreciation. It’s the kind of pace that allows market stability to thrive and buyers to plan wisely. For sellers, it brings assurance that home value isn’t disappearing overnight. And for the economy at large, it’s the goldilocks zone — not too hot, not too cold.

What’s driving this new balance?

Foreclosures remain historically low.

Lending standards are far stricter than the pre-2008 era.

Homeowners are sitting on record equity.

There’s no tsunami of forced sales looming.

In other words, the foundation is strong.

Regionally Speaking: Not One-Size-Fits-All

While the national conversation gives a broad overview, neighborhood trends are where the real stories live. In some local markets, especially those with surging inventory, prices might soften short-term. Elsewhere, demand is still far outpacing supply, keeping values elevated.

For example, in Florida’s prized southeast corridor, West Palm Beach is seeing intriguing movement. An influx of remote workers and relocating families is keeping the city’s real estate market vibrant.

Working with a West Palm Beach mortgage broker can unlock access to tailored lending options, especially if you’re exploring first time home buyer loans in West Palm Beach or seeking affordable West Palm Beach home loans that align with your long-term goals.

The Role of Equity and Why It Matters

Here’s the unshakeable truth: most homeowners today are not overleveraged. They’re not upside down. Thanks to years of rapid home price appreciation, they’re sitting on a cushion — sometimes a mountain — of equity.

This matters because in a downturn, equity acts like a shield. It prevents a spiral of forced sales and desperation listings. When people have options, the bottom doesn’t fall out.

Record equity levels across the nation are acting as an economic anchor. Add to that the fact that mortgage holders today mostly have ultra-low fixed rates, and there’s little incentive to sell under pressure.

What This Means for Buyers

Many are still trying to time the market, hoping a massive dip will deliver them a deal. But if you wait to buy, you may end up chasing an opportunity that never comes.

The current outlook calls for sustainable pace rather than spectacular gains. But here’s the twist: with home prices still inching upward, today’s prices could be tomorrow’s bargains.

That’s where mortgage preapproval in West Palm Beach becomes your advantage. It puts you ahead of casual lookers and positions you to act quickly when the right property hits.

Whether you’re curious about the best mortgage rates in West Palm Beach, exploring West Palm Beach refinancing options, or leveraging West Palm Beach mortgage calculators to plan your monthly payments, preparedness pays.

Don’t Overlook Commercial Opportunities

Residential housing isn’t the only story. Commercial mortgage broker in West Palm Beach services are also seeing upticks as investors hunt for income-generating properties. From mixed-use developments to hospitality revivals, there’s an undercurrent of movement in commercial real estate that signals long-term confidence.

Need property loan advice in West Palm Beach for an unconventional asset? Local expertise makes all the difference. And yes, it’s still possible to find attractive cap rates — if you know where to look.

A Word to Sellers

Thinking of listing? Now may be your window. Though appreciation is slowing, home values are still high compared to pre-pandemic levels. And buyers are adjusting to the “new normal” of interest rates.

In many local markets, properly priced homes are still moving quickly, especially if they’ve been well maintained and presented with care.

Work with local mortgage lenders in West Palm Beach to help your buyers navigate financing — and close with confidence. Consider offering assistance toward closing costs or interest rate buydowns to sweeten the deal in a shifting market.

The Market Isn’t Falling – It’s Evolving

The myth of an impending housing market crash persists. But data and expert consensus continuously refute it. Instead, what’s happening is a recalibration — a move from breakneck speed to strategic, forward-focused momentum.

Fannie Mae’s robust research, grounded in the insights of over 100 housing market experts, paints a clear path: slow and steady growth over the next five years. No freefall. No bubble burst.

For those in West Palm Beach, this means there’s still real opportunity. Whether you’re buying your first home, refinancing, investing, or simply staying informed, our local data matters most.

Bottom Line

The media may love a storm story, but this one’s mostly sunshine. Yes, there will be clouds. Some local markets may wobble. But overall, the direction is steady and upward. The foundation is sound. The professionals have spoken.

If you’re a first time home buyer in West Palm Beach, there’s no need to hesitate. If you’re considering refinancing options, now is the time to shop. If you’re wondering when the market will “bottom out,” you might be asking the wrong question.

Instead, ask this: Where do I want to be in five years? Because that’s the horizon the forecast is focused on — and it looks remarkably strong.

Ready to navigate this evolving landscape? Whether you’re after the best mortgage rates in West Palm Beach, need custom property loan advice, or want clarity on neighborhood trends, the tools and guidance are already within reach.

The truth about where home prices are heading? They’re not crashing. They’re cruising — and for those prepared, they’re creating opportunity.

Read from source: “Click Me”

© Copyright 2025 EPIC! LOANS and its licensors | All Rights Reserved.

© Copyright 2025 EPIC! LOANS and its licensors | All Rights Reserved.